Quantitative researcher & developer building AI-driven, multi-horizon trading systems and the tooling that supports them.

My work blends market micro-structure modelling, reinforcement learning, stochastic calculus and rigorous risk management to squeeze insight out of noisy markets.

I believe in grounding practical applications in solid theory. Here are some of the frameworks I've developed:

- Extended Geometric Information Framework Overview: A conceptual model blending ideas from physics, differential geometry, and game theory to describe agents in dynamic environments.

- A Full Market Dynamics Model (Draft): A formal mathematical system for modeling market environments with hierarchical rules, time-varying graphs, and multi-layered geometric surfaces.

These will both be available under the TMRW repo within the next month(July/2025)

| Repo | TL;DR |

|---|---|

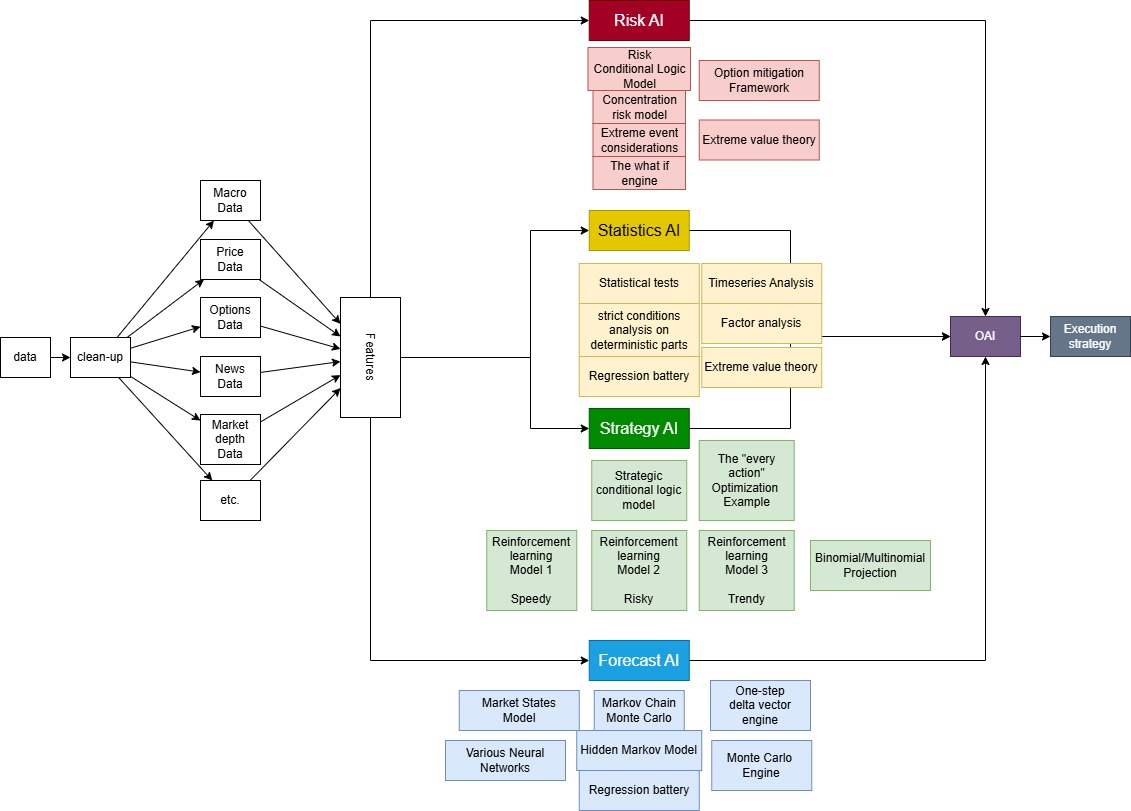

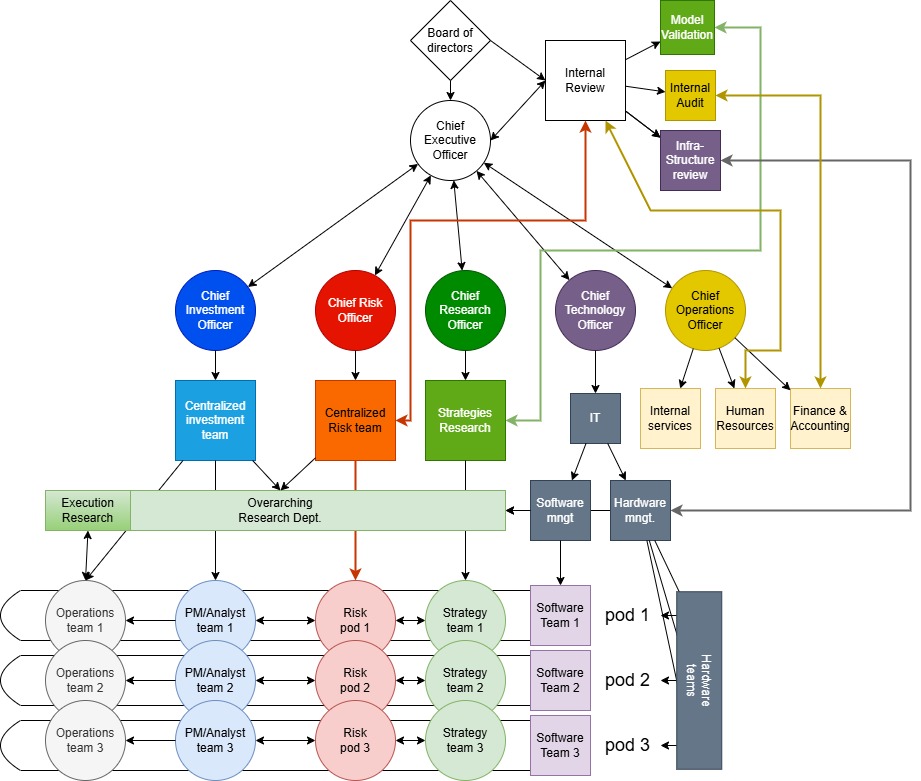

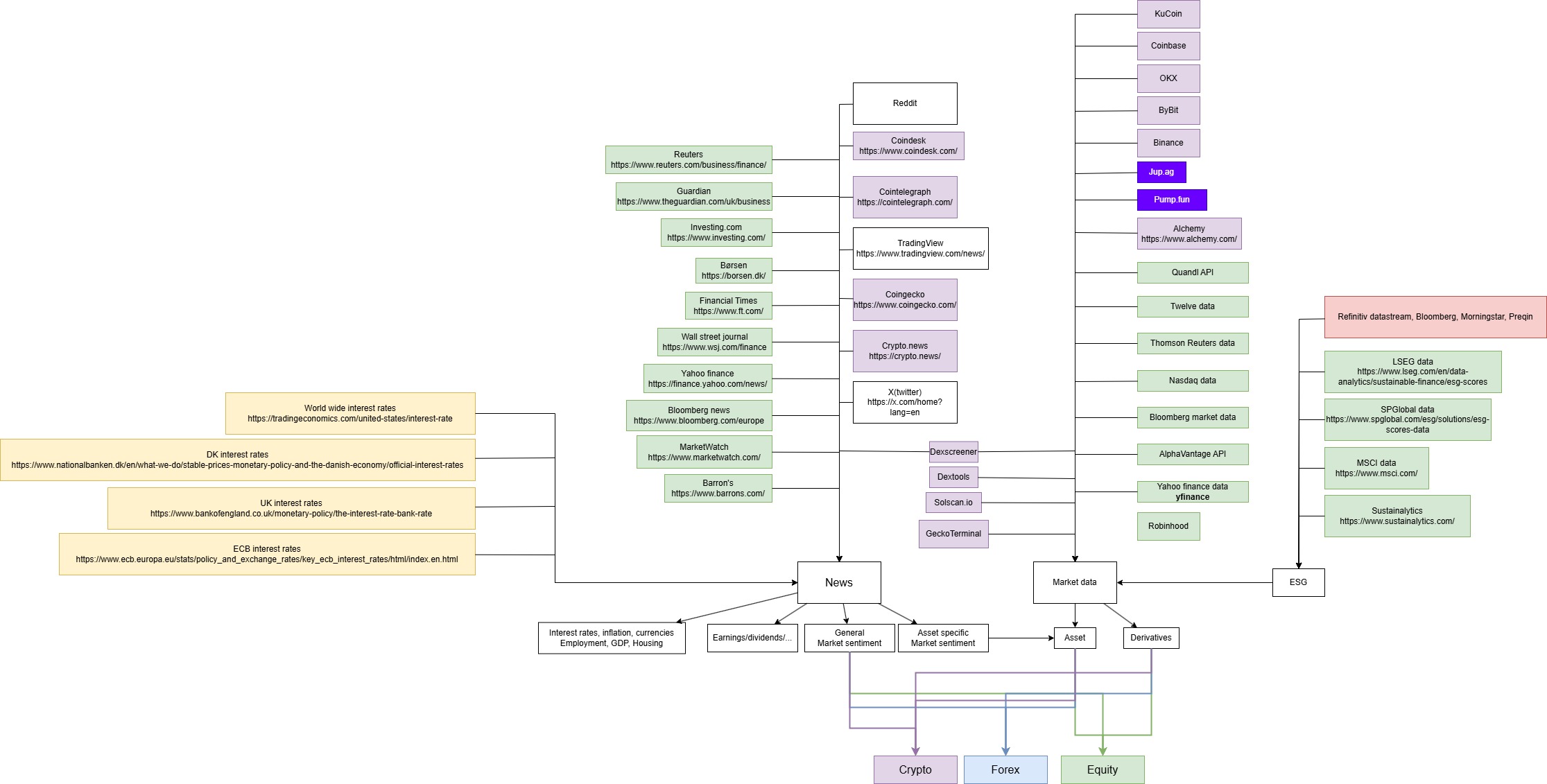

| TMRW part 1 | A research-grade framework that chains Risk AI, Stat AI, Strategy AI (RL) and Forecast AI pods from sub-second market-making to macro-thematic positioning. |

| TMRW part 2 | Live-trading playground for a startup: state-detection logic, tactic selection and execution notes for medium-frequency crypto & equity strategies. |

| Knowledgebase | 890-commit compendium of books, papers & notebooks across quant finance, insurance, maths and ML — currently being reorganised into step-by-step walkthroughs. |

| GoldenDice | Micro toolkit that Monte-Carlo simulates Brownian, CIR and OU paths for pricing and stress-testing. Great sandbox for stochastic-process intuition. |

| QPM | A collection of Jupyter notebooks that prototype mean–variance optimisation, actuarial cash-flows and other portfolio-math basics. |

|

|

|

|

The Strategy AI layer leans on the classical Avellaneda–Stoikov market-making model for optimal bid/ask placement.

Diagrams pulled straight from TMRW/util so they stay up-to-date with the code base.

Python | Jupyter | R | C++ | TensorFlow | PyTorch | CCXT | ARIMA/Prophet | Monte-Carlo sim | Reinforcement Learning (A2C, PPO)

…and a healthy dose of ☕ & 📊.

In other words

Languages: Python, R, C++, SQL

Machine Learning: TensorFlow, Keras, Scikit-learn, LightGBM, XGBoost, HMMlearn

Data Science: Pandas, NumPy, SciPy, Statsmodels

Data Visualization: Matplotlib, Seaborn

The handle is the IATA route I fly to visit my partner — Copenhagen → London.

LinkedIn

Email: mark@brezina.dk

Feel free to reach out if you'd like to collaborate or chat about quantitative finance and AI!